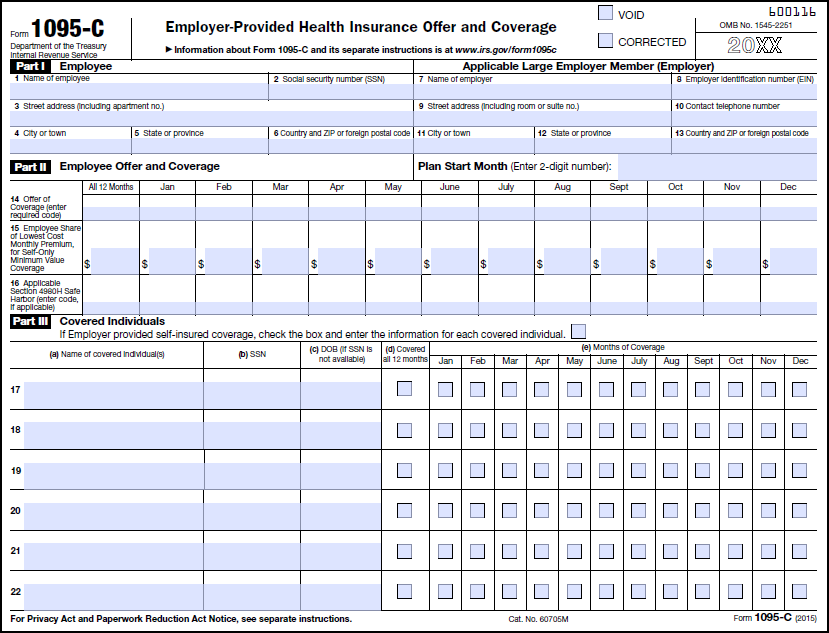

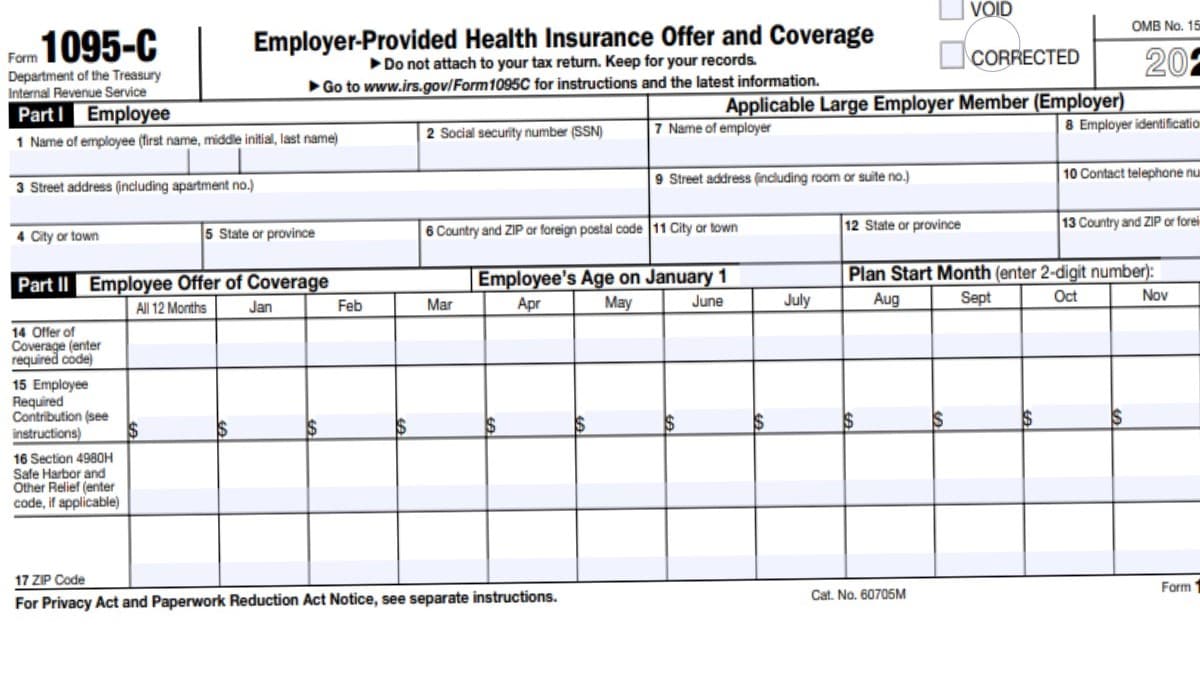

The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment According to the ACA, certain companies must provide an option for health insurance to their employees if the companies are ApplicableYour 1095C Tax Form for You will soon receive your 1095C via US Mail for the tax year containing important information about your health care coverage Employers are required to provide the 1095C to the following employees as part Where to locate the 1095C form in Edison Benefits Administration sends an annual email notice advising State employees that their digital copy of the 1095C form is available to view in Edison Benefits Administration only furnishes and distributes 1095C forms for State employees who were offered health insurance during the previous year

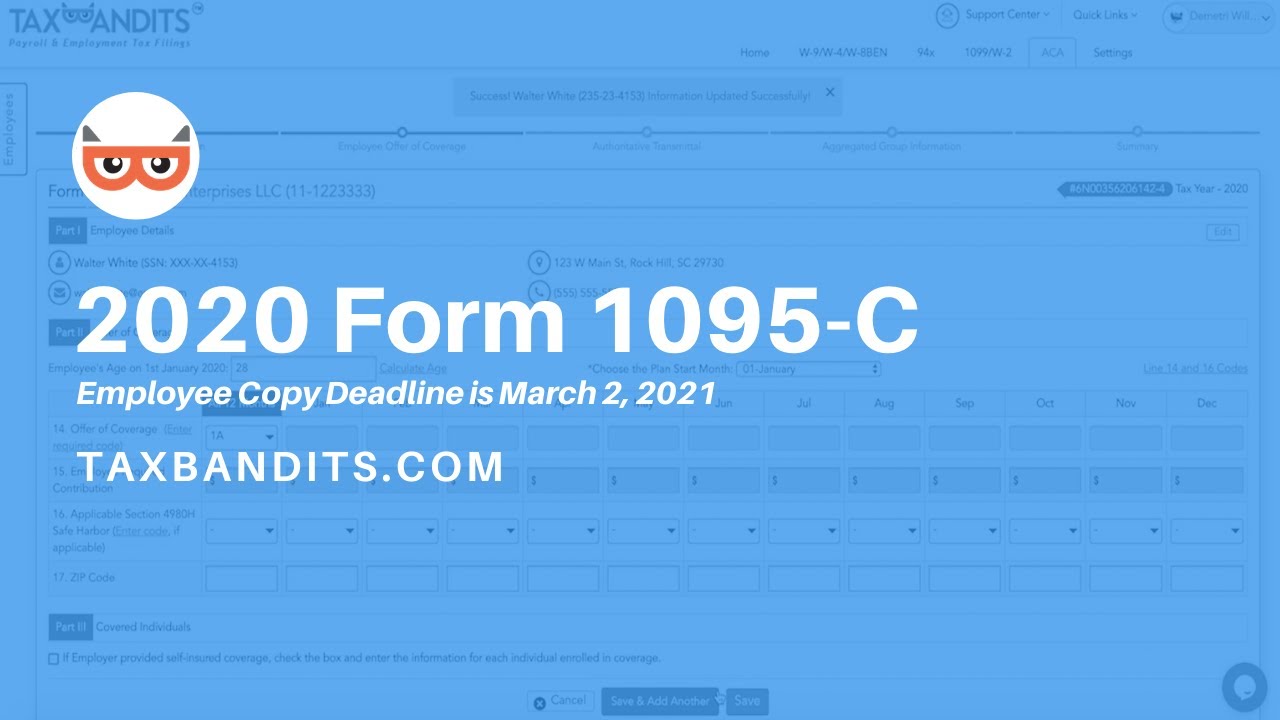

Large Employers What Are The Deadlines For Forms 1094 C And 1095 C Mitchell Wiggins

How to use form 1095-c

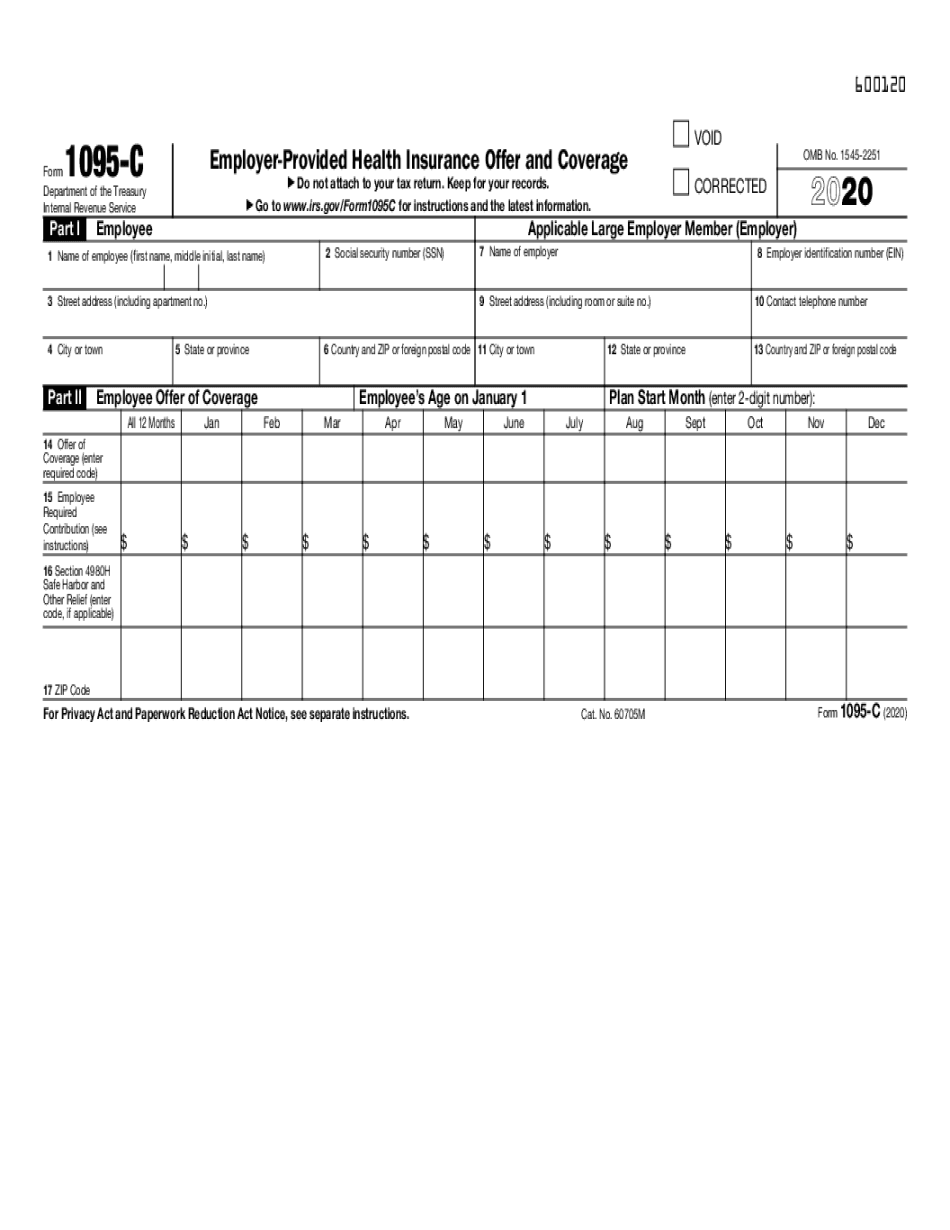

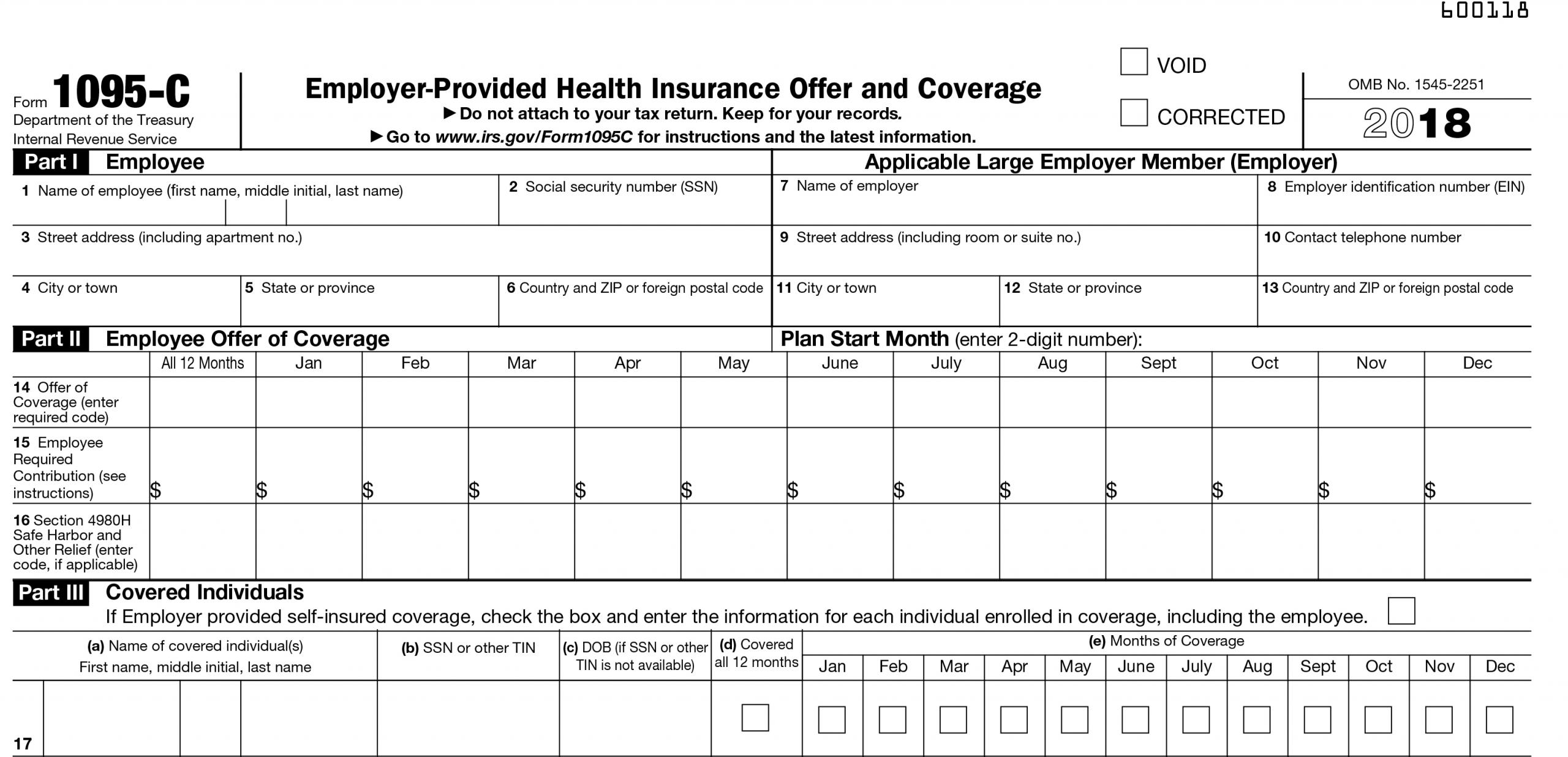

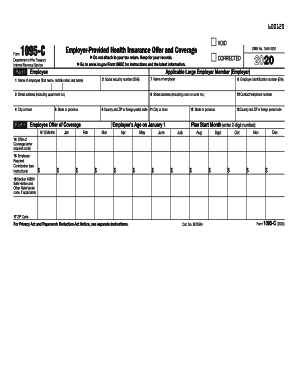

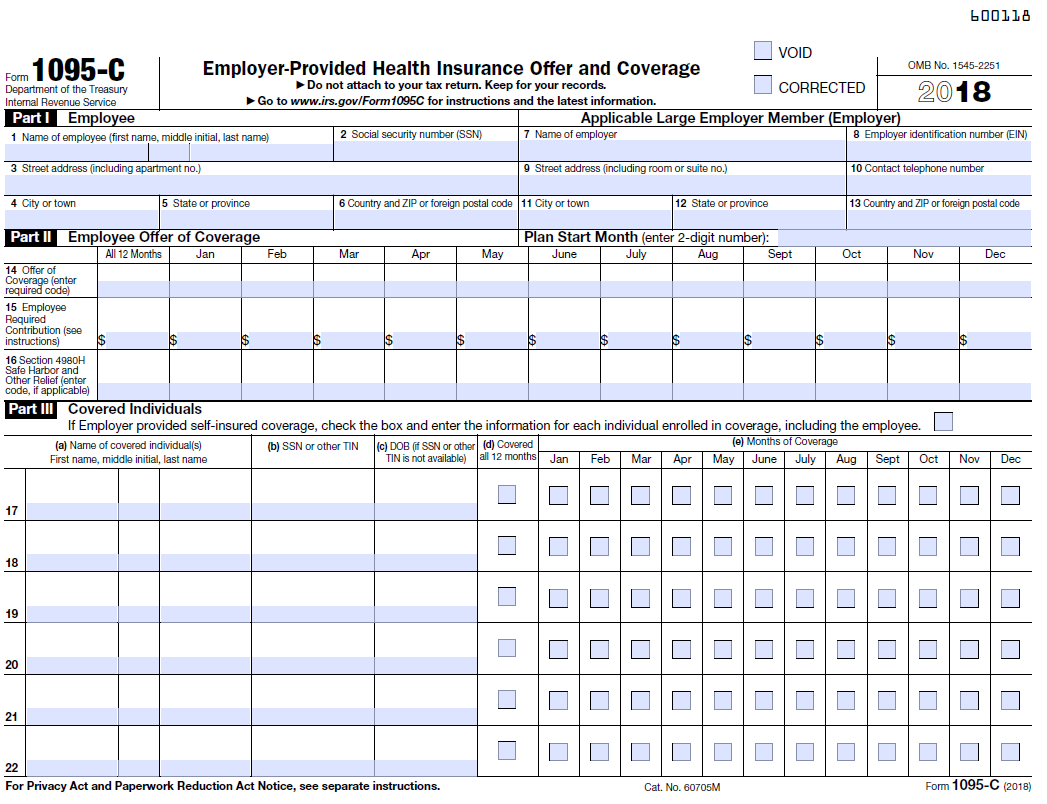

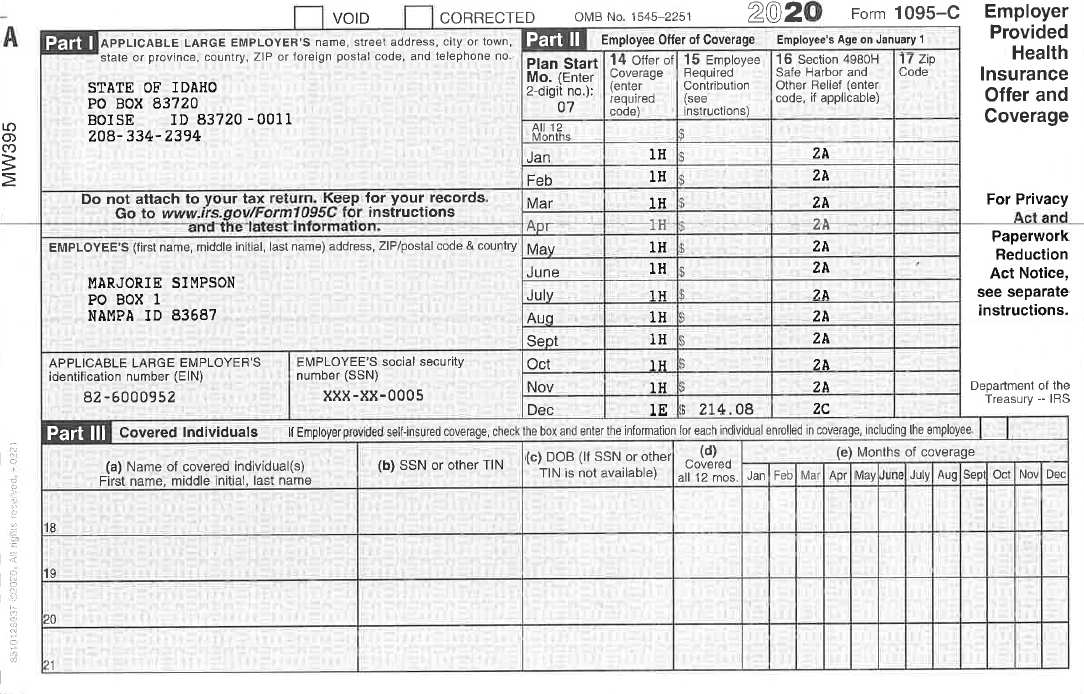

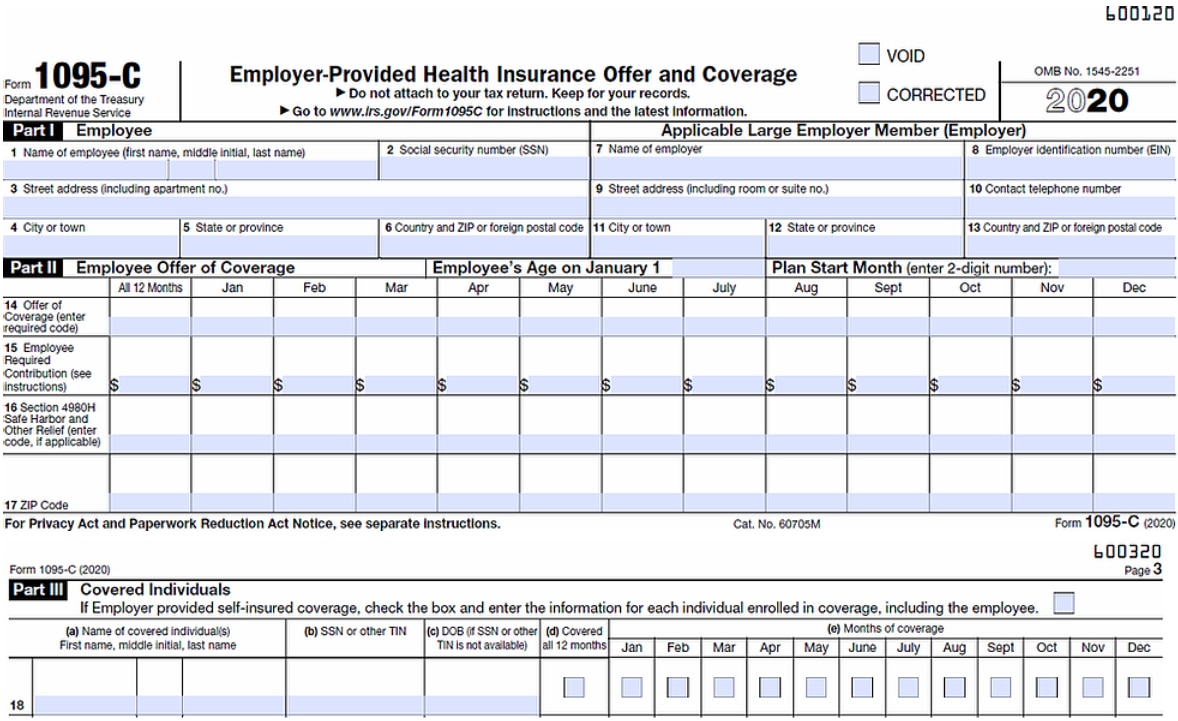

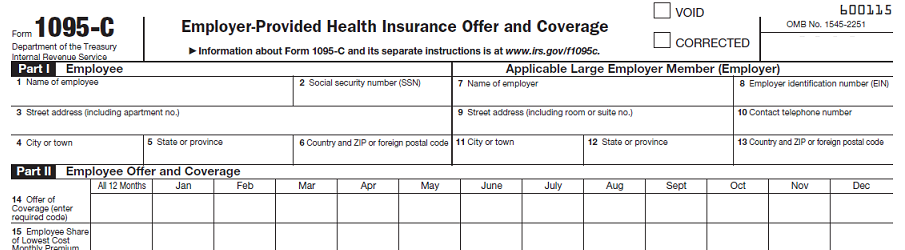

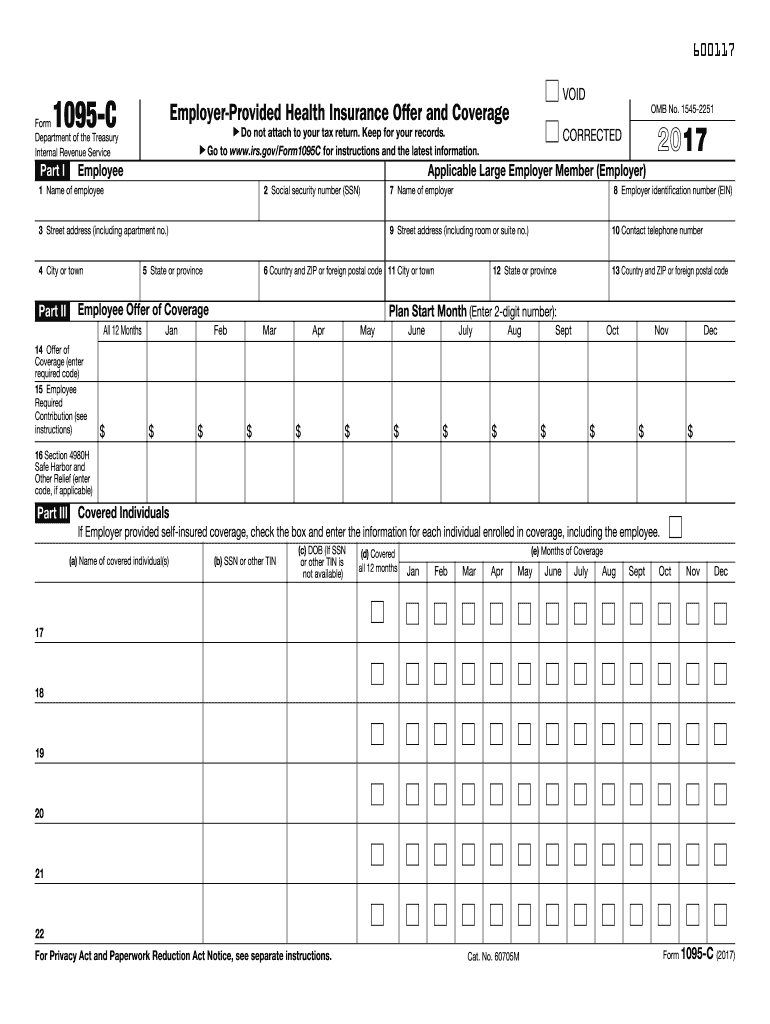

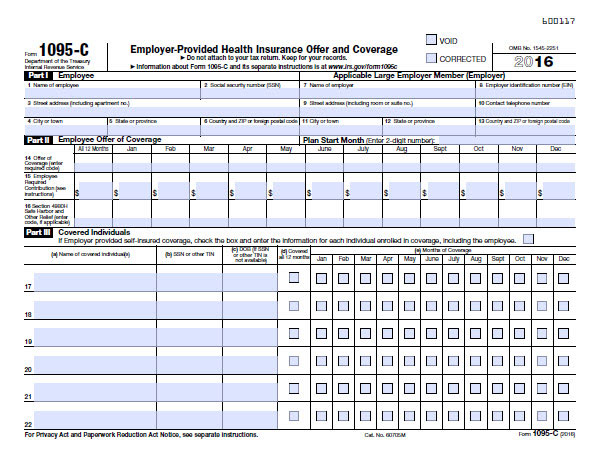

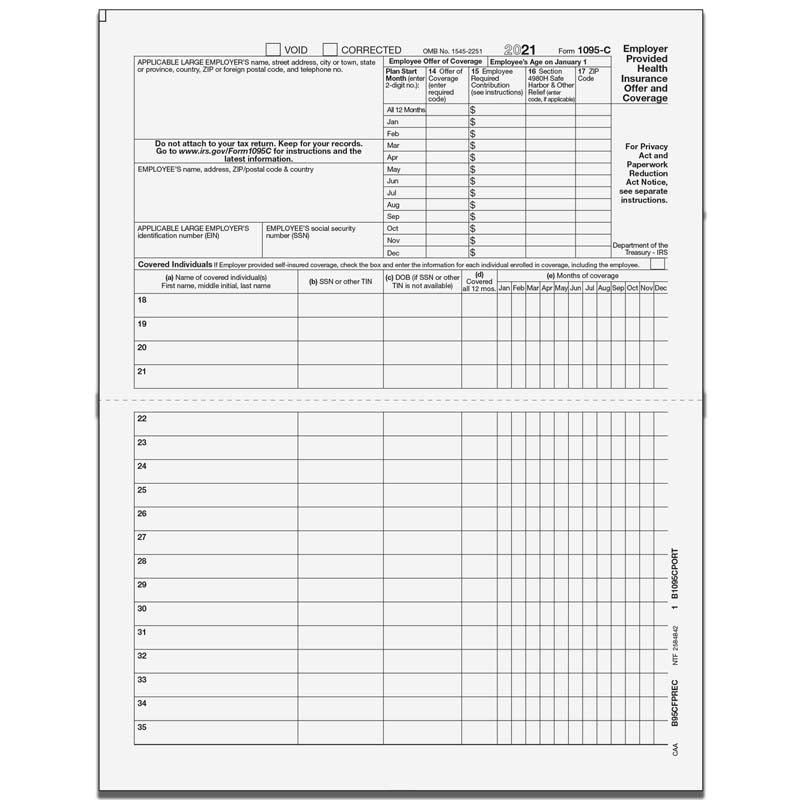

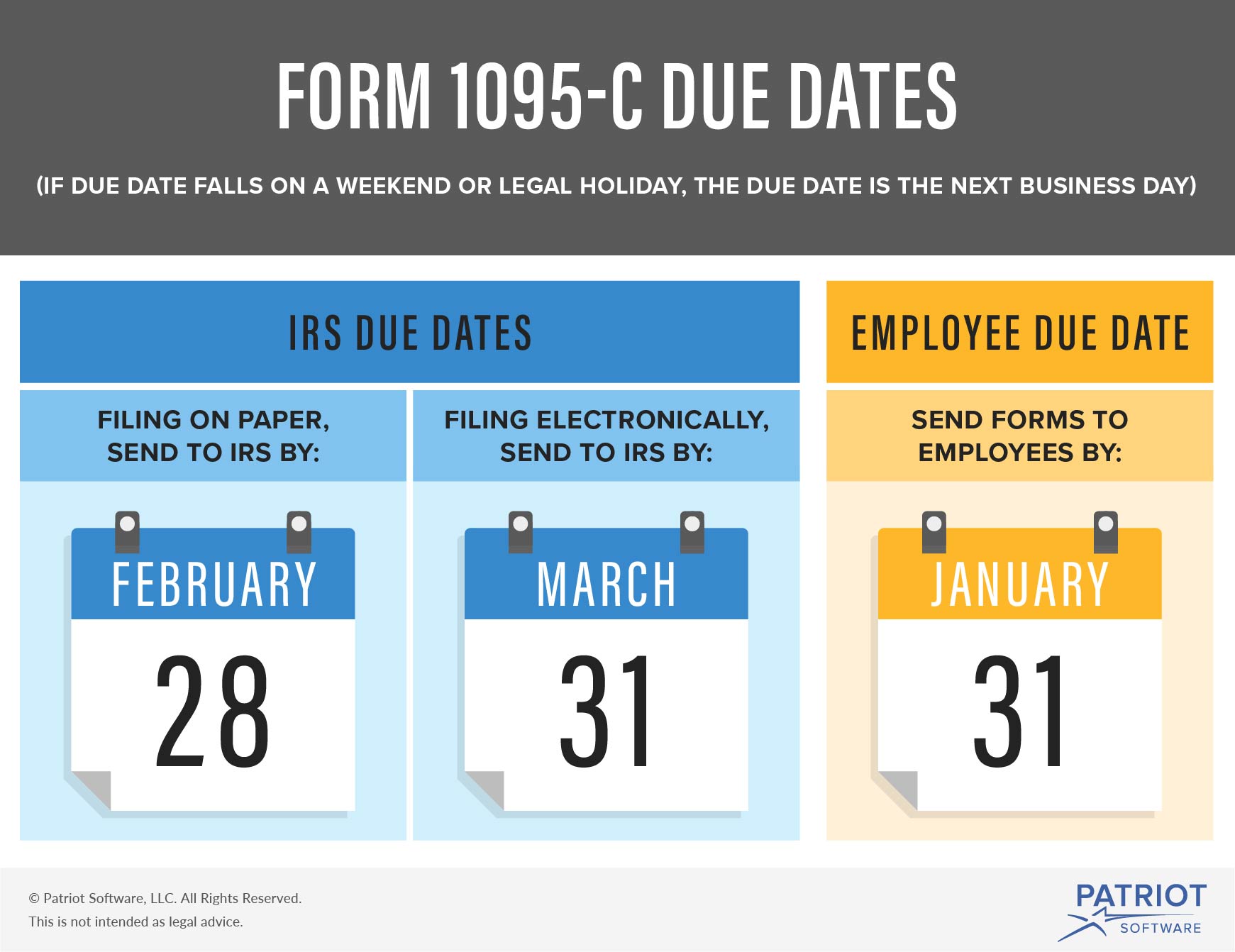

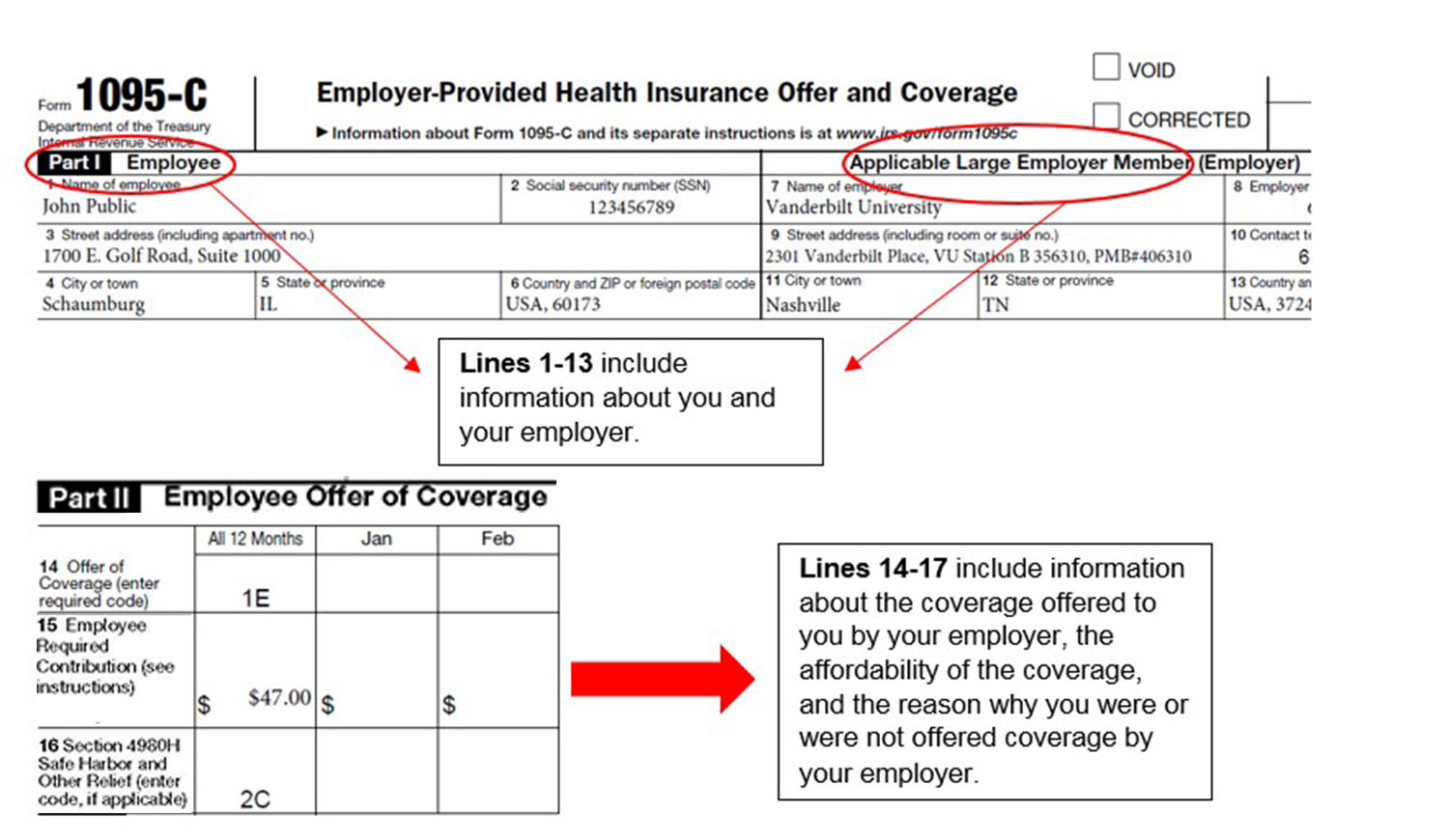

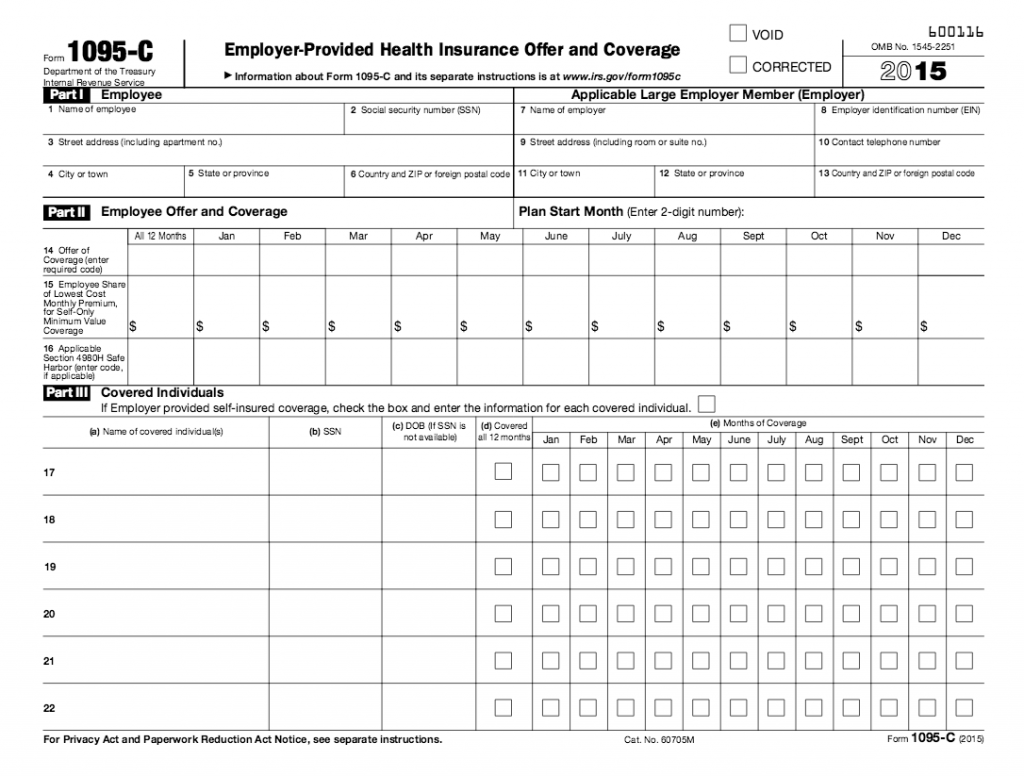

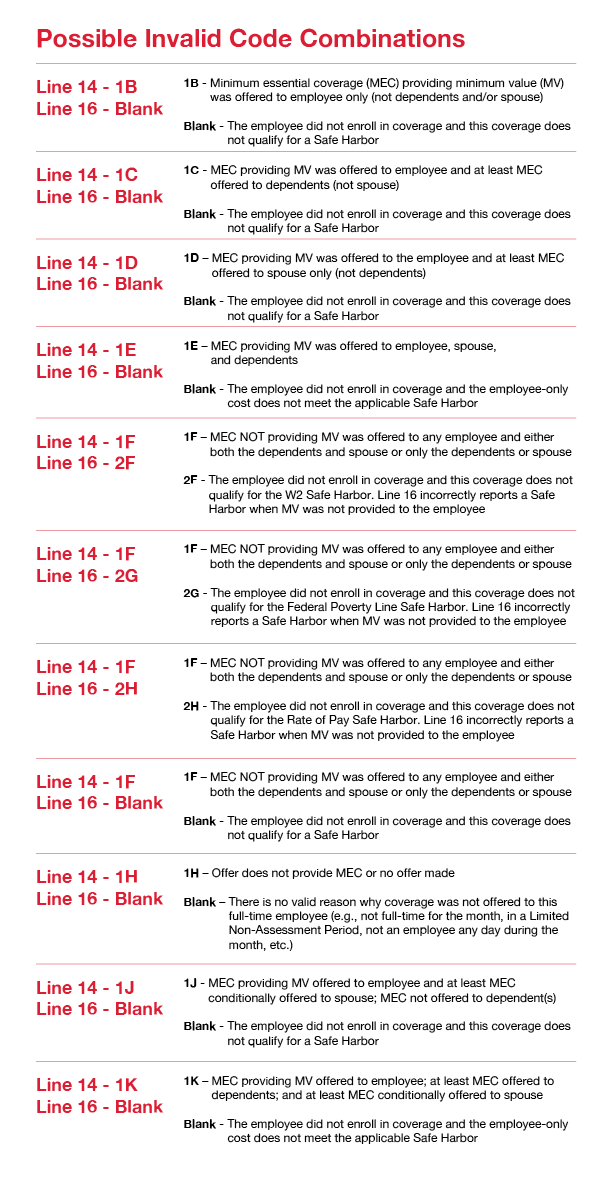

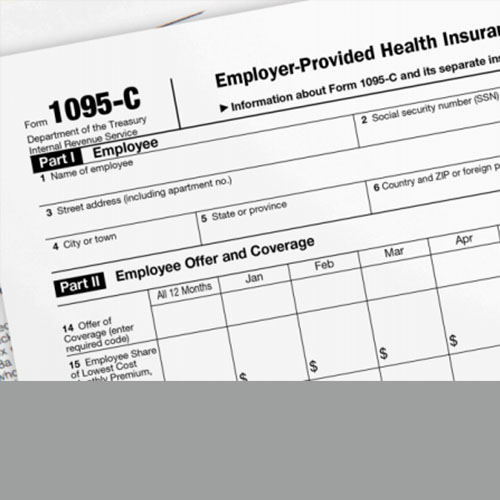

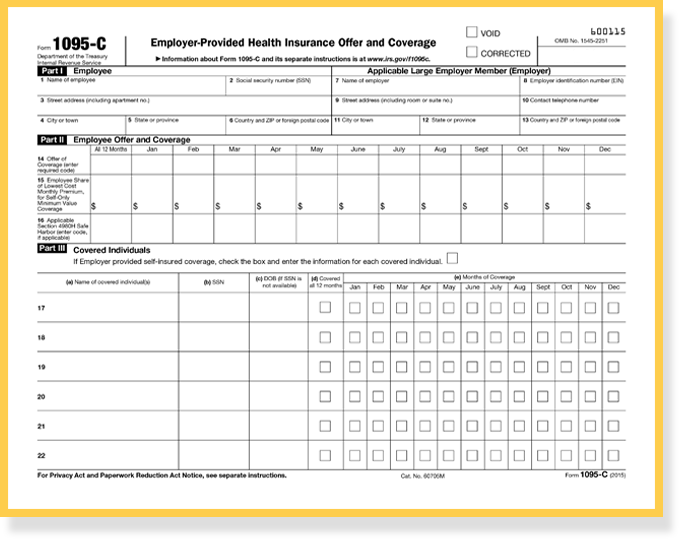

How to use form 1095-c-For the 15 tax year, ALEs must mail or handdeliver Forms 1095C to employees no later than When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

About the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C in HR/CMS SelfService For anyone who previously chose suppression of paper forms, the Form 1095C IRS Form 1095 C Information Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self Service It will be mailed to you by Form 1095C This tax form is normally sent to employees by their employer prior to January 31 each year IRS Notice 76 (page 6, paragraph A) extends the deadline to provide the form by Form 1095C for federal civilian employees paid by DFAS and military members will be available on myPay NLT January 31 Forms will be mailed

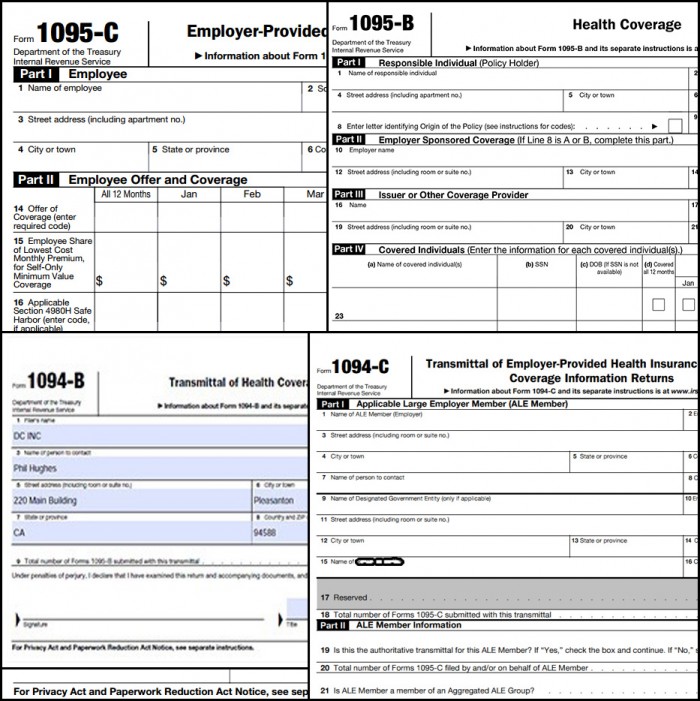

The ACA Form 1095C can be filed either electronically or on paper with the IRS However, the IRS encourages organizations to file electronically By Efiling, the IRS can process your returns more quickly, and you are also able to learn the status of your submission instantlyInst 1094C and 1095C Instructions for Forms 1094C and 1095C 16 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C Form 1095A, 1095B, 1095C, and Instructions The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage, so individuals won't have to fill them out themselves

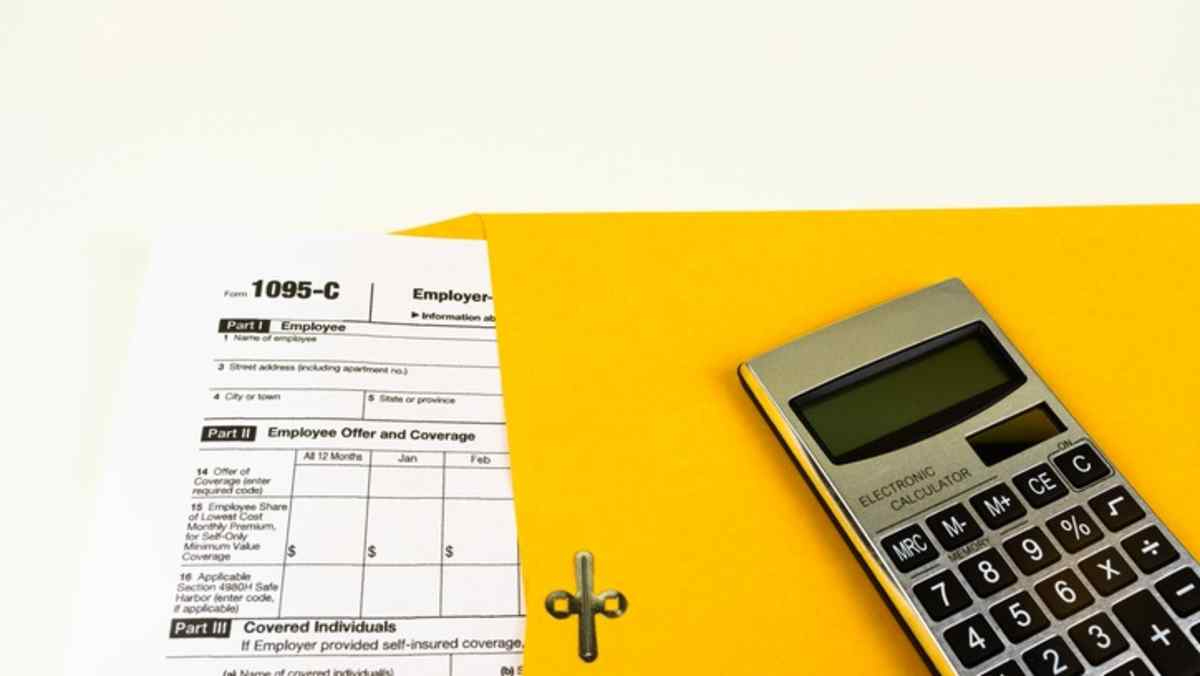

1095C Form Information This new 1095C Form, related to the Affordable Care Act (ACA), is a certificate of EmployerProvided Health Insurance Offer and Coverage Beginning with tax year 15, this form is required by all large employers to report offers of health coverage and enrollment in health coverage On Oct 2, , the IRS announced it would extend the deadline for employers to provide employees with a copy of their 1095C or 1095B reporting form, as required by the ACA, from Jan 31, 21Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee

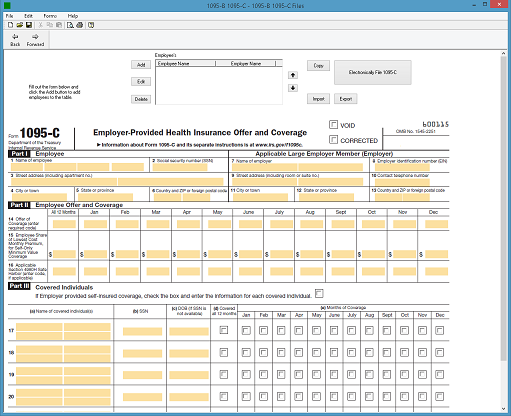

1094 C 1095 C Software 599 1095 C Software

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Form 1095C Line 16 Codes are used to report information about the type of coverage an employee is enrolled in and if the employer has met the employer's shared responsibility "Safe Harbor" provisions of Section 4980H The table below explains the code series 2 to be reported on line 16 of Form 1095CEncuentra toda la información que necesitas saber sobre el formulario de impuestos sobre seguros de salud de California, 1095A, para preparar tu declaración de impuestosForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

What Payroll Information Prints On Form 1095 C To Employees

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Applicable Large Employers (ALEs) now have until , to provide Forms 1095C to individuals If you work for an organization that employs more than 50 employees, you will receive a Form 1095C from your employer and may need to submit information from it as a part of your personal tax filing What is Form 1095C?What is Form 1095C?Form 1095C is a tax form under the Affordable Care Act ("ACA") which contains information about your healthcare insurance coverage It serves as an "offer of coverage" statement that shows the Internal Revenue Service ("IRS") that the City of New York "the City" offered coverage to its

Irs Drafts Of New 16 Forms 1095 C 1094 C Leavitt Group News Publications

1095 C Faqs Office Of The Comptroller

Form 1095C may be used to support proof of coverage and/or the offering of employer sponsored insurance on your tax filing However, you may not need to wait to receive your 1095 form(s) to complete your taxes Please visit the IRS page on health care information forms for more information If you believe the information on your Form 1095C isAbout the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C in HR/CMS SelfServiceThe purpose of filing Form 1095C, EmployerProvided Health Insurance Offer and Coverage by the applicable large employers is to report their employee's health coverage information to the IRS

Irs Form 1095 C Uva Hr

Irs 1095 C Form Pdffiller

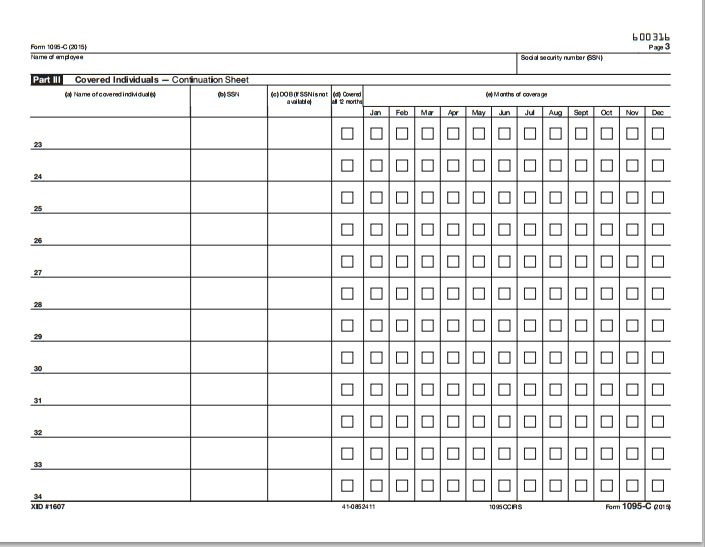

I have Covered California from July to Dec (1095A Form), my previous employer sent me 1095C for Jan to May but there is no where I can enter on Turbo Tax I heard if you don't have health insurance for 3 months you are fined Funny that if I delete my 1095A from my TurboTax my refund goes up by $10Each Form 1095C is counted as a separate return, and only Forms 1095C are counted in applying the 250return threshold for section 6056 reporting For more detailed information, including on how this rule applies for corrected returns, see the Instructions for Forms 1094C and 1095C and Affordable Care Act Information Returns (AIR) ProgramEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records

Control Tables And Sample Forms

What Your Clients Need To Know About Form 1095 C Accountingweb

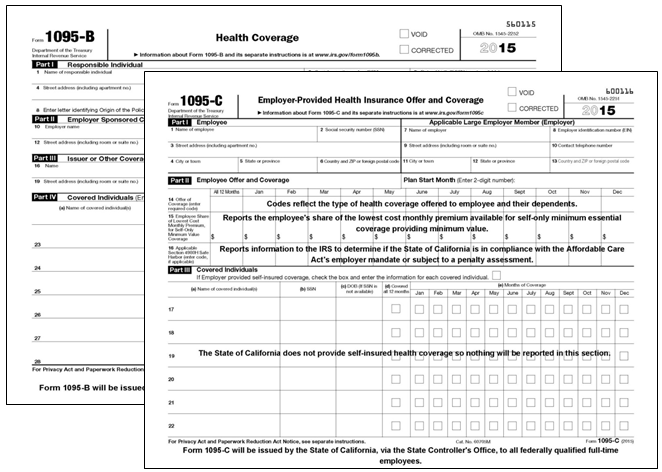

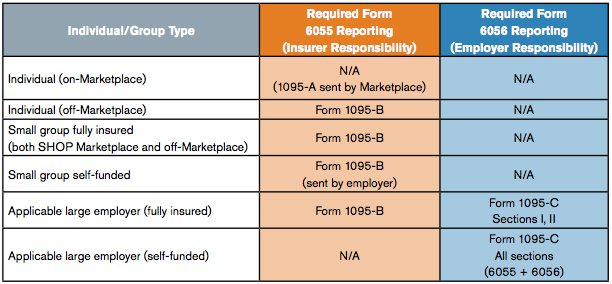

Form 1095B, Health Coverage, should come in the mail if you purchased or received insurance outside of an exchange Form 1095C, EmployerProvided Health Insurance Offer and Coverage, is required by companies who meet the qualifications to be considered Applicable Large Employers This includes employers with 50 or more fulltime employees in Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was covered This form is sent out by the insurance provider rather than the employer Form 1095C is a tax form that provides you with information about employerprovided health insurance Only employees who is offered coverage under a policy through an Applicable Large Employer (ALE) receive Forms 1095C, and it is the responsibility of the ALE to generate and furnish the documents to all employees who were fulltime (as

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Accurate 1095 C Forms A Primer Erp Software Blog

Form 1095C is a reference document that is not completed by the taxpayer It is not filed with a tax return Instead, it should be kept with the taxpayer's records Part I of the form provides IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage," is a document your employer may have sent you this tax seasonDuring the year will also receive a Form 1095C This group may include terminated COBRA participants, retirees, or nonemployee directors of the company When will employees receive the Form 1095C?

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Irs Form 1095 C Codes Explained Integrity Data

Payroll Services In January, fulltime employees receive a tax form, Form 1095C, that contains detailed information about their health care coverage It is important to keep the form for your records because you will need it to file your tax returnsEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records Form 1095C Form 1095C is sent out by large employers who are required to offer health insurance coverage as a provision of the ACA This applies to employers with 50 or more fulltime equivalent employees Form 1095C is sent to the IRS and to the employees

Irs Form 1095 C Fauquier County Va

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

As a reminder, applicable large employers (ALEs) provide the Form 1095C to individuals If the plan is fully insured, the insurance carrier also provides the Form 1095B to covered individuals (in addition to the Form 1095C provided by the ALE) unless the carrier is taking advantage of the section 6055 furnishing relief described aboveThe information contained on Form 1095C is informational and allows the preparer to verify that the taxpayer and/or their dependents have minimum essential health care coverage Although the Shared Responsibility Payment (or penalty) has been eliminated by the Tax Cuts and Jobs Act starting with the tax year 19 , employees will continue toReference Guide for Part II of Form 1095C Lines 14, 15, and 16 (revised for the final 17 forms) November 17 • Lockton Companies L O CKT O N CO M P ANIES GLOSSARY Children means an employee's biological and adopted children (including children placed with the employee for adoption), from birth, adoption, or placement through the end of the month in which the child

1095 C Continuation Forms Official Irs Version Zbp Forms

Complyright 1095 C Employer Provided Health Insurance Offer Coverage Form 100 Ac1095e0s17 Walmart Com Walmart Com

Form 1095C is a new form designed by the IRS to collect information about applicable large employers and the group health coverage, if any, they offer to their fulltime employees Employers will provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS1095C, EmployerProvided Health Insurance Offer and Coverage, is an IRS form used by Applicable Large Employers (ALEs) to report information about employee's health coverage Businesses with 50 or more fulltime employees are termed as ALEs Form 1095 C should be filed with the IRS, and copies should be furnished to employees

Clearing Aca Confusion Which Employees Get Irs Form 1095 C

Irs Mailing Deadline February 28 Aca Gps

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

1095 C Form 21 Finance Zrivo

1095 C 18 Public Documents 1099 Pro Wiki

1095 C Employer Provided Health Insurance Offer Of Coverage

Ez1095 Software How To Print Form 1095 C And 1094 C

1095 C Forms Full Sheet With Instructions On Back Discount Tax Forms

1095 C Print Mail s

1

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct

trix Irs Forms 1095 C

1

Benefits 1095 C

Need To Correct An Irs 1094 C Or 1095 C Form

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 C Faqs Mass Gov

1095 C Continuation Forms For Complyright Software Discount Tax Forms

Accurate 1095 C Forms Reporting A Primer Integrity Data

Understanding Form 1095 C And What To Do About Errors The Aca Times

Changes Coming For 1095 C Form Tango Health Tango Health

Form 1095 C Mailed On March 1 21 News Illinois State

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

1

1094 C 1095 C Software 599 1095 C Software

1095 C Employer Provided Health Insurance Irs Copy For 21 5098b Tf5098b

Large Employers What Are The Deadlines For Forms 1094 C And 1095 C Mitchell Wiggins

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Changes Coming For 1095 C Form Tango Health Tango Health

1095 C Template Fill Online Printable Fillable Blank Pdffiller

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Overview Of 1095c Form

Form 1095 C Guide For Employees Contact Us

Accurate 1095 C Forms Reporting A Primer Integrity Data

Annual Health Care Coverage Statements

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Code Series 2 For Form 1095 C Line 16

1095 C Form Official Irs Version Discount Tax Forms

What Does A 1095 C Delay Mean For 1040 Filings Integrity Data

1095 C Preprinted Portrait Version With Instructions On Back

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

Your 1095 C Obligations Explained

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

Form 1095 A 1095 B 1095 C And Instructions

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

Form 1095 C Forms Human Resources Vanderbilt University

Cobra Retiree 1095 C Form Questions Answered Tango Health

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C Forms Complyright Software Version Zbp Forms

Hr Updates Theu

1095 C Form Educating Employees And Filing Extensions Tango Health

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

1095 C Forms Half Sheet With Instructions At Bottom Discount Tax Forms

Amazon Com 18 Complyright 1095 C Employer Provided Health Insurance Offer And Coverage Form Landscape Irs Copy Laser Cut Sheet Pack Of 500 1095cirs500 Office Products

Instructions For Forms 1095 C Taxbandits Youtube

Free 1095 C Resource Employee Faqs Yarber Creative

Amazon Com 18 Complyright Ac1095e150 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 50 Employees Office Products

Tax Form Preparation Software 1095 C Software To Create Print And E File Forms 1094 C 1095 C

Enroll In Employer Sponsored Health Insurance With Irs Form 1095 C

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

Payroll 1095 C Information Affordable Care Act Aca

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Electing To Receive Your 1095 C And W 2 Forms Electronically 19 Social Security Wage Base Increase

An Overview Of 1095 A 1095 B 1095 C Affordable Care Act Forms

Your 1095 C Tax Form My Com

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Pressure Seal 1095 C Form Ez Fold Zbp Forms

The Abcs Of Form 1095

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Form 1095 C H R Block

Alert Irs Extends Due Date For Forms 1095 C And 1095 B

Changes Coming For 1095 C Form Tango Health Tango Health

Your 1095 C Obligations Explained

Sample 1095 C Forms Aca Track Support

1

What Is The Irs 1095 C Form Miami University

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Do Dependents Spouse Need To Be Reported On 1095 C Forms

What Is Form 1095 C And Do You Need It To File Your Taxes

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

0 件のコメント:

コメントを投稿